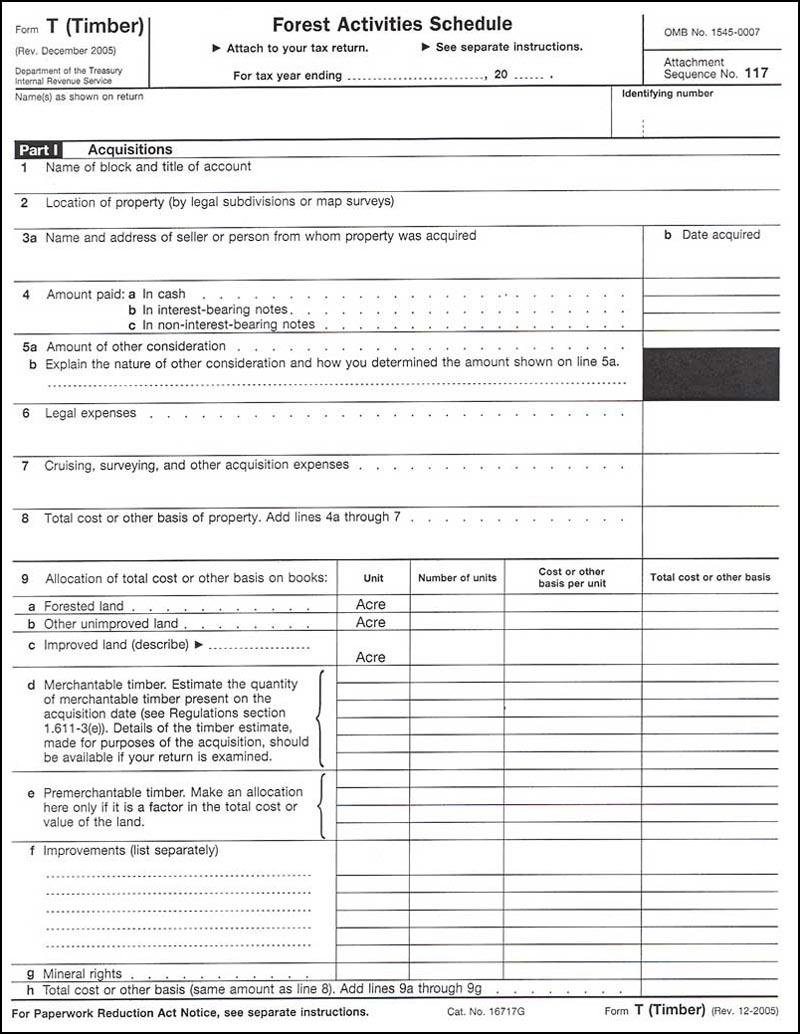

Tax rates are set by the governing bodies of the taxing jurisdictions and property values are determined by the Appraisal District.įailure to send or receive the tax bill required, does not affect the validity of the tax,penalty,or interest, the due date, the existence of a tax lien, or any procedure instituted to collect a tax. Enter Search Value: - without any prefix or suffix to find all records where a column contains the value you enter, e.g. You must include the Ag/Timber Number on the agricultural exemption certificate (PDF) or the timber exemption certificate (PDF) when buying qualifying items.

#Texas ag exemption number search registration#

Harrison County Tax Office collects property tax for the County and other jurisdictions. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller.

Texas Parks & Wildlife Registration Renewal 1-80.The registration number is an eleven digit number assigned by the Comptroller that begins currently with a 1 or a 3. “Auto Title Transfers/Parks & Wildlife transactions are processed Monday thru Friday before 4:30pm Monday-Thursday and Friday before 2:00pm.” Hallsville Office Ag/Timber Number Search Agricultural Timber Exemption Application Search by Registration Number: Searching by registration number will result in you finding data specific to that number. Hallsville & Waskom 8:30am-4:45pm Monday-Thursday,

#Texas ag exemption number search how to#

More information on what is considered tax exempt and how to obtain an Ag/Timber Exemption can be found here.“Auto Title Transfers/Parks & Wildlife transactions are processed Monday thru Friday before 4:30pm.”

the application is an easy process, applicants will need a few items to reach completion: To serve as a leader in ensuring consumer protection, advancing Arizona agriculture, and safeguarding agricultural commerce. Those who do not already have an exemption number can initiate their application process on the comptroller’s website. While they do not replace a properly completed exemption certificate, they can be copied and shared with others who will be making purchases with theexemption. Once your application has been processed, you will receive a confirmation letter accompanied with two courtesy cards. Individuals who wish to obtain their registration number can start a new account or log into an existing account on the comptroller’s website.

Renewals can be completed over the phone by calling 844-AGRENEW (84). Within this site, you will find general information about the district and the ad valorem property tax system in Texas, as well as information regarding. Numbers must be renewed in order to continue to claim an exemption on qualifying agricultural and timber purchases made after that date.

0 kommentar(er)

0 kommentar(er)